The Dubai Financial Services Authority (DFSA) has announced exceptional achievements for the first half of 2024.

Publish dateSunday 1 September 2024 - 15:16

In the announcement of the Dubai Financial Services Authority (DFSA), it is emphasized that it has brought the total number of supervised institutions to 837.

According to the announcement, the wealth management sector experienced a 62% increase in authorized entities, which has strengthened DIFC's status as the premier hub for private banking and wealth management in the region.

The DIFC also now hosts 27 of the 29 G-SIBs, underscoring its vital role in the global banking network.

The DFSA helped facilitate the growth of capital markets in the DIFC, which remains the world's largest ESG sukuk market and the second largest listed sukuk market after Dublin with values of $16.6 billion and $90.9 billion respectively.

In addition, the center hosts 199 securities on its official list valued at $166.3 billion, including 43 ESG securities valued at $28.6 billion on Nasdaq Dubai, cementing its role as a major player in sustainable finance. does

DFSA's proactive approach to policy development has significantly enhanced its regulatory frameworks by fostering a culture of implementing international best standards and practices and engaging in active stakeholder management.

In the first half of 2024, the DFSA published six consultation papers on a variety of important topics, including the regulation of digital currencies, the audit regime, crowdfunding and credit funds.

Reinforcing its commitment to protecting the reputation and integrity of the financial services industry, the DFSA has taken enforcement action and issued nine public warnings to consumers and the financial community about common and more sophisticated forms of fraud.

The DFSA also published four key reports on corporate disclosure, brokerage, private banking and liquidity coverage ratios, which provided valuable insight to the industry.

To foster dialogue and promote ongoing engagement, the DFSA held numerous engagement meetings and roundtables with key stakeholders in the first half of 2024 and participated in more than 20 high-profile local and international events.

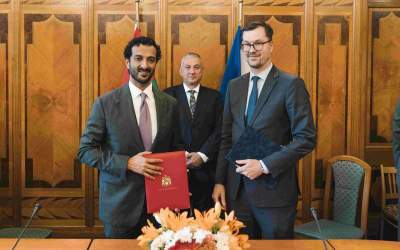

The DFSA has strengthened its relationships and alliances with regulatory peers around the world and close to home, while continuing to play an active role in relevant international standard setting bodies.

amacnews.com/vdcd.z0f2yt0okme6y.html

Source : news agency wam

Most viewed